CERTIFICATE OF DEPOSIT (CD) QUESTIONS AND ANSWERS

What are Certificates of Deposit (CDs)?

CDs, often also called time deposits, are a savings vehicle similar to a savings or money market account, but guaranteeing a fixed rate in return for a consumer’s commitment to keep the money deposited until a specified date (the maturity date). Only in rare circumstances, and with the payment of a penalty, can the money be withdrawn early, and then it is at the bank’s discretion.

What are advantages and disadvantages of certificates of deposit compared to a savings account?

Since the rate is fixed, you avoid the risk of falling savings rates. You take on the risk of rising rates. Rates are above savings rates to compensate you for the risk of rising rates and to provide you with a premium for agreeing to keep your money on deposit until maturity. You should consider the rates above carefully in comparison with the best savings rates that may be available to you. Depending on your view of the direction of rates and the trajectory at which you believe they will rise, you may be more inclined to stick with shorter maturities (1-year) or you may find that that the premium of any CDs over savings rates does not provide adequate compensation.

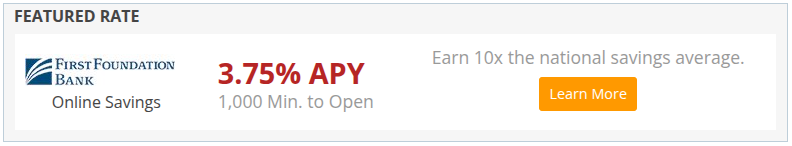

What are the top current CD rates?

The table above lists best CD rates currently offered for several different maturities (lengths). Rates on longer maturities are ordinarily higher as they provide greater compensation for the risk of rising rates and provide you with a greater premium of depositing your money for a longer time.

Are the funds in certificates of deposit insured?

CDs in FDIC-insured or NCUA-insured institutions are insured so long as you remain within relevant insurance limits, ordinarily to a maximum of $250,000 within an ownership category. If you hold a CD that is accruing interest during the course of CD, you may wish to consider depositing no more than such amount that will, when combined with any other accounts you have at the bank or credit union, exceed $250,000 at maturity.

What is a reasonable Early Withdrawal Fee?

An Early Withdrawal Fee (also called an Early Termination Fee) is the fee charged by a bank for early termination of a CD (termination before maturity). This fee is ordinarily expressed by the bank in terms of months of interest, rather than as a flat fee, and if the CD is cancelled before that period has passed may reduce principal. A reasonable fee for early withdrawal from a CD (early termination of a CD) is said to make the CD more liquid. Rates & Info believes that a reasonable early withdrawal fee for a CD of less than one year is 3 months’ interest and a reasonable early withdrawal fee for a CD of 18 months to 5 years is 6 months’ interest. In a rising interest rate environment or one where you require liquidity, you should avoid CDs with more onerous Early Withdrawal Fees. Under any circumstance, you may wish to also favor No Penalty CDs. You may wish to read this important article in a competing website which indicates that banks may retain the right not to allow early termination even with payment of this fee.

Should I invest in CDs?

Your own risk tolerance level and personal situation determines your allocation to cash versus risk assets. Cash can be apportioned between savings accounts and CDs. However, if you feel interest rates will rise quickly, you should keep all of your cash in high-interest savings accounts.

The graph above shows how the average rates for CD accounts have trended over the last several years.

The graph above shows the difference in rate between average 5-year CD rates and average 1-year CD rates.

I've been unable to log on all evening because of the AWS outage. Also, I waited on hold for over 1 hour before giving up. Unable to get access to my money and disappointed by the AWS reliance with no re... More Reviews